CAPITAL A FIRST QUARTER 2024 OPERATING RESULTS

Aviation: International travel demand drives strong performance with record 90% load factor and 15.4 million passengers carried

MOVE Digital: AirAsia MOVE maintains strong user base as average Monthly Active Users surge 19% YoY, BigPay's carded users rise 12% YoY

Teleport: Cargo segment grows 79% YoY, delivering over 63,000 tonnes while daily deliveries reach a new average of 172,000 parcels

Aviation Services: ADE, Santan and GTR growth is in tandem with AirAsia strong performance

KUALA LUMPUR, 29 April 2024 - Capital A Berhad (“Capital A” or the “Group”) has announced the operating statistics for its aviation, digital, logistics and aviation services segments for the First Quarter of the Financial Year 2024 (“1Q2024”).

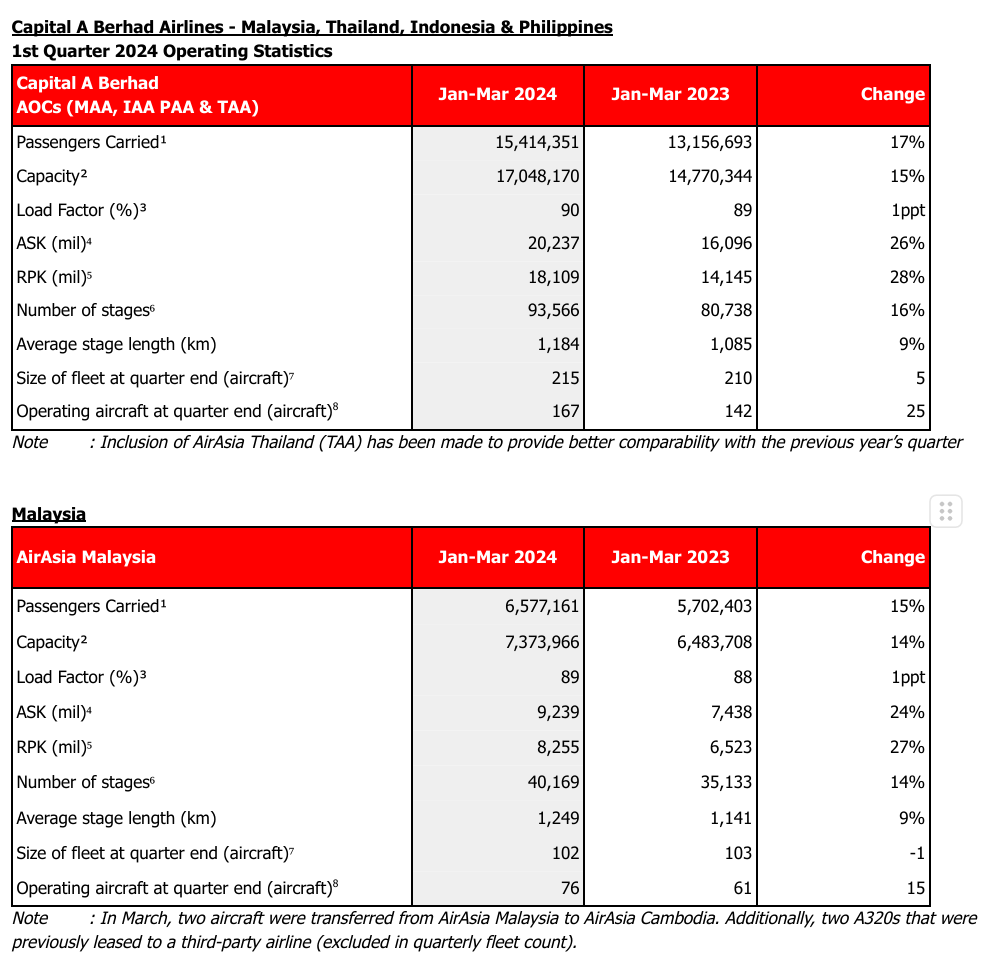

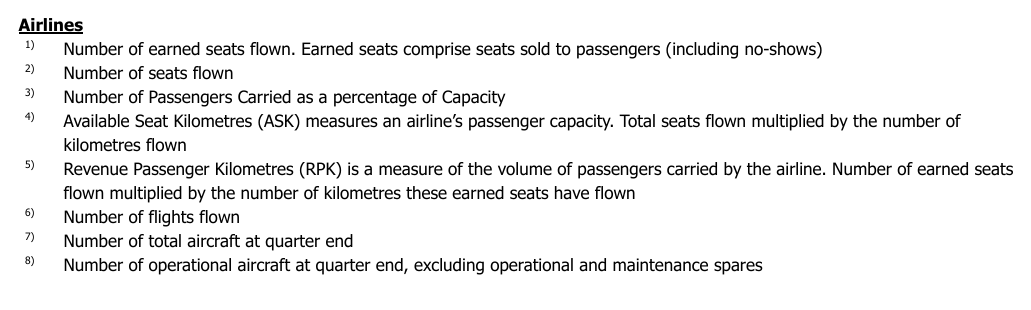

AIRASIA AVIATION GROUP

The airlines – AirAsia Malaysia, AirAsia Thailand, AirAsia Indonesia, and AirAsia Philippines (collectively the “Group”) delivered improved performance across key metrics, with a system-wide record quarterly load factor of 90%, reflecting a 1 percentage point (“ppt”) improvement Year-on-Year ("YoY"). This robust performance aligns with AirAsia's strategic focus on expanding capacity and rebuilding its network. Passenger volume grew 17% YoY to 15.4 million, outpacing capacity growth of 15% YoY, demonstrating continued strong travel demand across the region. The growth was largely attributed to school holidays and Chinese New Year season in the first quarter. Additionally, the resurgence of China and India routes both delivered a robust load factor of 94%, higher than pre-covid due to the visa-free travel corridors of both regions introduced at the end of 2023. As of the end of March, the airline group deployed 167 operational aircraft.

Notably, passenger recovery reached 84% of pre-Covid levels YoY, with both domestic and international segments experiencing growth at a similar rate, while capacity recovery achieved 82% YoY. AirAsia Philippines and Thailand emerged as the Group's top performers, boasting the highest load factors at 93% each. AirAsia Malaysia and Indonesia followed closely with impressive load factors of 89% and 83%, respectively. To capitalise on this robust demand, the airline Group is currently prioritising the active expansion of its capacity and network to meet strong growing demand.

MOVE DIGITAL

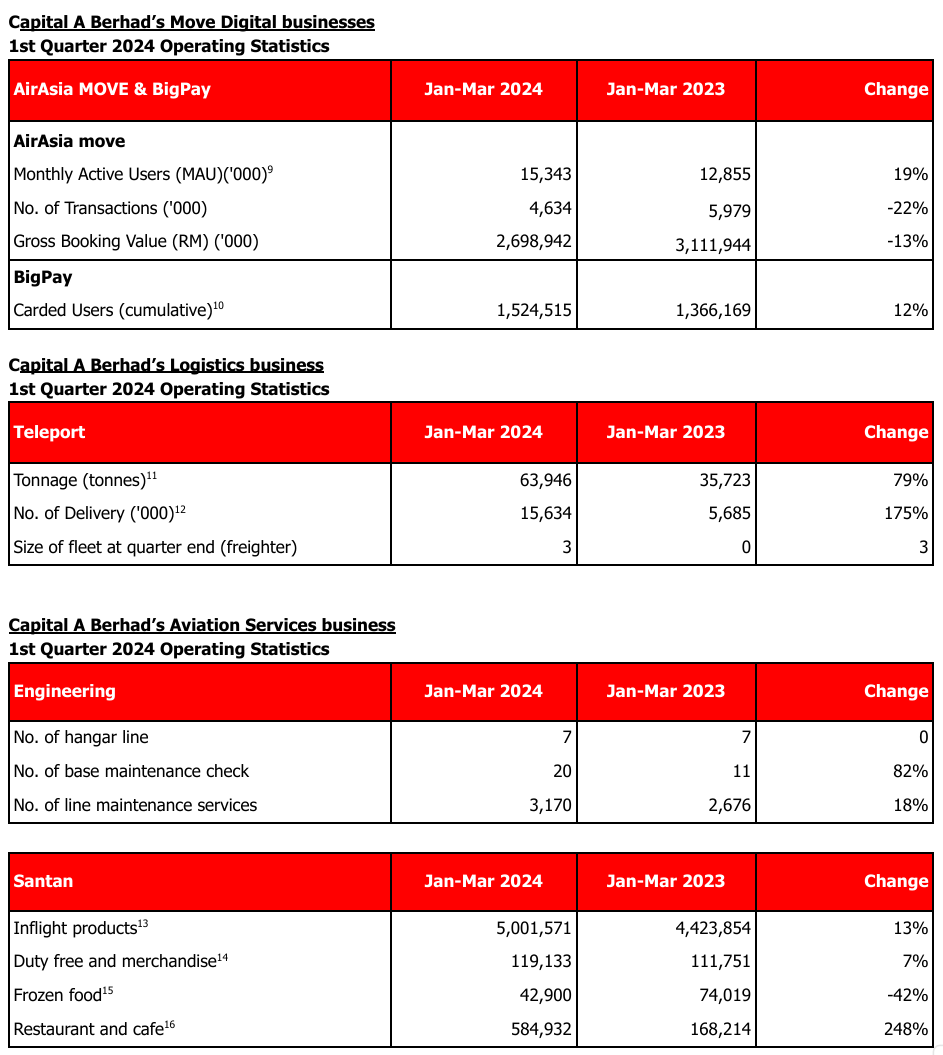

AirAsia MOVE, formerly known as airasia Superapp, continues to maintain a strong user base, exceeding 15 million Monthly Active Users (“MAU”) in 1Q2024 and recording a 19% YoY growth in MAU.

Travel: In 1Q2024, there was a strategic shift in our business model to move away from Business to Business (“B2B”) while focusing on Business to Consumer (“B2C”) that led to higher commission and conversion rates. Our main focus is to keep our users active, increase app stickiness and improve conversion rates. We aim to position ourselves as a top-of-mind OTA platform, prioritising member engagement over one-time transactions. Within the travel segment, we witnessed an 11% YoY jump in the average daily bookings for flights from other airlines, hotel bookings up 44% quarter-on-Quarter (“QoQ”) largely attributed to enhanced inventories and more effective marketing strategies. Additionally, the increased redemption of AirAsia flights in the Rewards segment partly offset the lower Gross Booking Value (“GBV”) in the Travel segment.

Ride-hailing: Completion rates for airport trips have improved by 6% YoY, as AirAsia MOVE doubled down on its commitment as a key airport-focused ride-hailing provider. However, shortage of active drivers and demand throughout the month of Ramadhan has resulted in 24% lower GBV for the quarter.

AirAsia Rewards and other businesses: Posted GBV growth of 24% YoY in 1Q2024, driven by an increase in point redemptions for AirAsia flights by our members during the festive season.

BigPay’s quarterly carded users, grew steadily at 12% YoY to 1.5 million. Gross Transaction Value (“GTV”) showed an 8% YoY decline due to deliberate efforts to shed unprofitable GTV.

Payment: Reduced by 23% YoY through deliberate efforts to shed unprofitable GTV, aligned with our focus towards achieving profitability.

Remittance: Grew by 19% YoY during the quarter, driven by a 43% YoY increase in domestic transfers with strong adoption of DuitNow. International transfers saw a moderate drop due to the depreciation of the Malaysian ringgit.

Lending: Value of loan disbursements grew 261% YoY as demand remains strong, with shifting user preference to mid-longer term loans with more affordable monthly instalment payments.

Marketplace: Remained stable YoY growth in mobile prepaid top-up transactions.

LOGISTICS

Teleport delivered a strong performance across its Cargo and Solutions (formerly known as Delivery) segments thanks to its ability to customise the rotations of the three freighters and utilisation of partner airlines’ networks to optimise how we better serve both cargo and eCommerce customers. This capability is further boosted by the continued recovery of AirAsia fleet capacity.

Cargo segment: Teleport delivered 63,945 tonnes during the quarter, a 79% increase from the same quarter in 2023, while the utilisation rate rose 5% YoY to 16% during the quarter, even as capacity increased 25%, reflecting greater demand and better operating efficiency.

Solutions segment: Over 15.6 million parcels were delivered in 1Q2024, a 175% improvement from the same quarter in 2023, while daily deliveries reached a new average of 172,000.

AVIATION SERVICES

Asia Digital Engineering (“ADE”)

Fueled by the significant uptick in air travel, Maintenance, Repair and Overhaul (“MRO”) service provider, ADE enjoyed a stellar start to 2024. Remarkably, the company completed 82% more base maintenance checks compared to the same period last year. This performance is well within expectations, as hangar slots have been fully booked until the end of 2024. Additionally, ADE exhibited agility in catering to time-sensitive maintenance needs, with line maintenance checks experiencing an 18% YoY increase.

Santan

The Group’s inflight service provider, Santan recorded 5.1 million units sold in the first quarter of 2024, up 13% YoY.

Perishable and non-perishable food and beverages: Unit sold climbed by 13% YoY, exceeding 5 million units during the quarter. This growth is particularly notable in the international flight segment.

Duty-free and merchandise products: Nearly 120,000 units sold recorded in 1Q2024, reflecting a 7% YoY increase, attributing to increased international flight frequencies and passenger volume.

Frozen meal segment: The segment recorded sales of over 42,000 units in 1Q2024 and there has been realignment in partnerships. A new strategy has been implemented in April which will improve future performance with initial indicators showing positive signs.

Restaurant and cafe segment: Grew 248% YoY with over half a million units sold in the first quarter of 2024 alone, driven by new corporate discount programs, as well as the introduction of new menu offerings in the festive season.

ASSOCIATE COMPANY

Ground Team Red (“GTR”)

The Group’s affiliated ground handling services company, GTR sustained commendable growth:

Flight handling: Over 35,000 flights were handled during the year, which rose by 8% YoY – which aligned with the expansion of AirAsia’s flights which offset the flight reduction which was caused by the exit of a third-party airline.

Passenger handling: 5.6 million passengers or 11% more passenger volume YoY were handled in the first quarter aligned with the extended school holiday period in mid-1Q2024.

Cargo handling: Over 30,000 tonnes of cargo were recorded in 1Q2024. This surge can be attributed to two key factors: the expansion of flight frequencies and the addition of three Teleport freighters to the fleet, which significantly boosted cargo capacity.