AirAsia Group Berhad IR News: Second Quarter 2020 Preliminary Operating Statistics

Recovery Seen in Demand

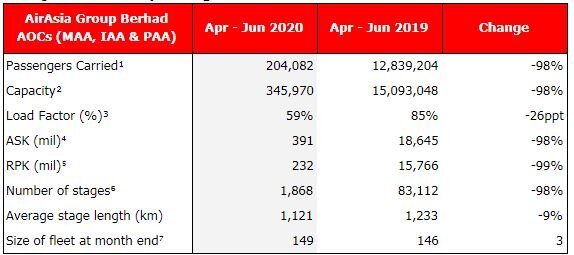

AirAsia Group Berhad (“AirAsia” or “the Group”) is pleased to present the operating statistics for the Second Quarter of the Financial Year 2020 (“2Q2020”).

AirAsia gradually resumed operations at end-April as domestic travel restrictions eased. The Group saw a pick up in key operational metrics in June as compared to May, including tripling the number of passengers carried by AirAsia Malaysia, doubling the number of passengers carried by AirAsia Thailand, and increasing 10 percentage points in load factor while reaching 6 times the number of passengers carried by AirAsia India, reflecting the strong rebound demand for air travel.

AirAsia Malaysia doubled up capacity in June 2020, compared to May 2020, as the Malaysian government began allowing interstate travel from 10 June. AirAsia Malaysia achieved a 65% load factor while carrying 118,407 passengers in June 2020, having reopened 24 routes by month's end. AirAsia Malaysia expects to recover 65-70% of its pre-Covid-19 domestic capacity by 4Q.

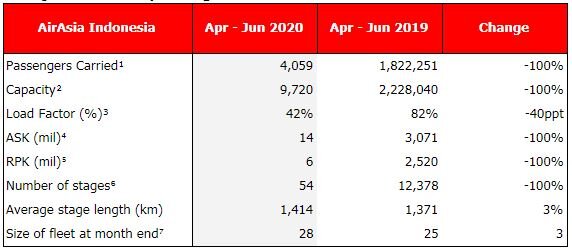

As a result of the fleet hibernation, AirAsia Indonesia’s number of passengers carried fell by 99.8% year-on-year to 4,059. As the company remains committed to essential movement of people and cargo, AirAsia Indonesia operated a number of charter flights during the quarter, some of which had longer distance, contributing to a 3% increase in average stage length. AirAsia Indonesia resumed operations on 19 June with 5 routes. At the end of July, the daily sales have reached 5 times of the daily sales recorded in early June, evidently showing signs of demand recovery.

AirAsia Philippines registered a 99% decline in number of passengers carried as the airline entity hibernated its fleet from 20 March to 4 June. AirAsia Philippines boasted 19% of capacity market and ended the quarter with the resumption of 6 routes. For the 4Q this year, AirAsia Philippines is targeting a recovery of domestic capacity up to 60% of pre-Covid-19 levels.

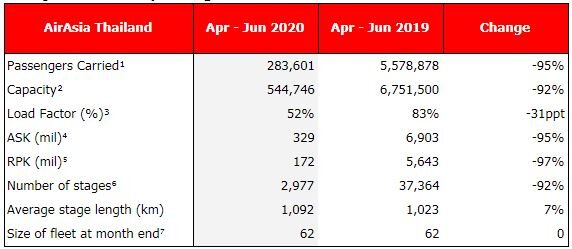

In May 2020, AirAsia Thailand reinstated domestic flights in phases as lockdown measures were partially uplifted, but with social distancing measures implemented on-board as required by the authorities, before the measures were eased in mid-June. With the encouraging rebound traffic, AirAsia Thailand operated 18% of pre-Covid-19 capacity in June 2020, which more than doubled the May 2020 capacity. AirAsia Thailand resumed service to 18 of its domestic destinations in 2Q2020, topping peers with a leading capacity market share of 33%. In 3Q and 4Q of this year, AirAsia Thailand expects to operate 75% and 95% of pre-Covid-19 domestic capacity respectively.

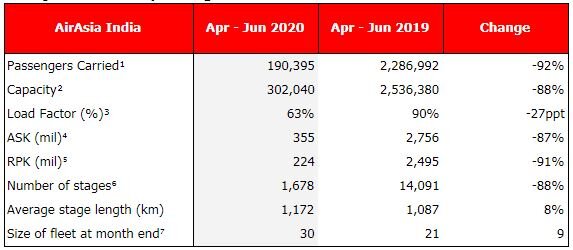

AirAsia India restarted its domestic operations on 25 May 2020, and was quick to ramp up to 30% of pre-Covid-19 capacity in June 2020, with 36 operational routes. The Group is optimistic over AirAsia India’s performance and is looking at domestic capacity resumption of 55% for 3Q and 80% for 4Q out of last year’s operations.

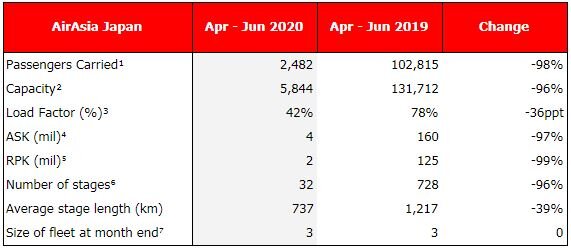

AirAsia Japan reported a decline of 98% in passengers carried with 4% operating capacity in 2Q2020, as flights were not restarted due to guidelines set by the government. AirAsia Japan resumed operations on 1 August 2020.

AirAsia Group Berhad Consolidated AOCs - Malaysia, Indonesia & Philippines

2nd Quarter 2020 Operating Statistics

Note: (i) The fleet count excludes:

Two (2) A320 aircraft leased to a third party airline

Malaysia

2nd Quarter 2020 Operating Statistics

Note: (ii) The fleet count excludes:

Two (2) A320 aircraft leased to a third party airline

Indonesia

2nd Quarter 2020 Operating Statistics

Philippines

2nd Quarter 2020 Operating Statistics

Thailand

2nd Quarter 2020 Operating Statistics

India

2nd Quarter 2020 Operating Statistics

Japan

2nd Quarter 2020 Operating Statistics

Number of earned seats flown. Earned seats comprise seats sold to passengers (including no-shows)

Number of seats flown

Number of Passengers Carried as a percentage of Capacity

Available Seat Kilometres (ASK) measures an airline’s passenger capacity. Total seats flown multiplied by the number of kilometres flown

Revenue Passenger Kilometres (RPK) is a measure of the volume of passengers carried by the airline. Number of passengers multiplied by the number of kilometres these passengers have flown

Number of flights flown

Number of aircraft including spares