CAPITAL A THIRD QUARTER 2024 OPERATING RESULTS

AirAsia: Carries over 45 million passengers Year-To-Date, maintaining a high load factor of 90%

CAPAS: ADE's base capacity grows to 12 hangar lines while line checks for third-party airlines increase by 20% on quarter; Santan’s ready-to-eat segment records nearly 300x increase on year

Teleport: Cargo segment moves over 70,000 tonnage up by 25% on year, while delivery segment surpasses FY2023 total delivery by a significant 56%

MOVE Digital: Travel segment remains the core driver for AirAsia MOVE with non-AirAsia flights and hotel bookings soaring in 3Q2024, 44% of BigPay’s new users acquired via AirAsia MOVE

KUALA LUMPUR, 24 October 2024 - Capital A Berhad (“Capital A”) has announced the operating statistics for its aviation, Capital A Aviation Services (“CAPAS”), Teleport, and MOVE Digital segments for the Third Quarter of the Financial Year 2024 (“3Q2024”).

3Q2024 OPERATING HIGHLIGHTS OF AIRASIA AVIATION GROUP

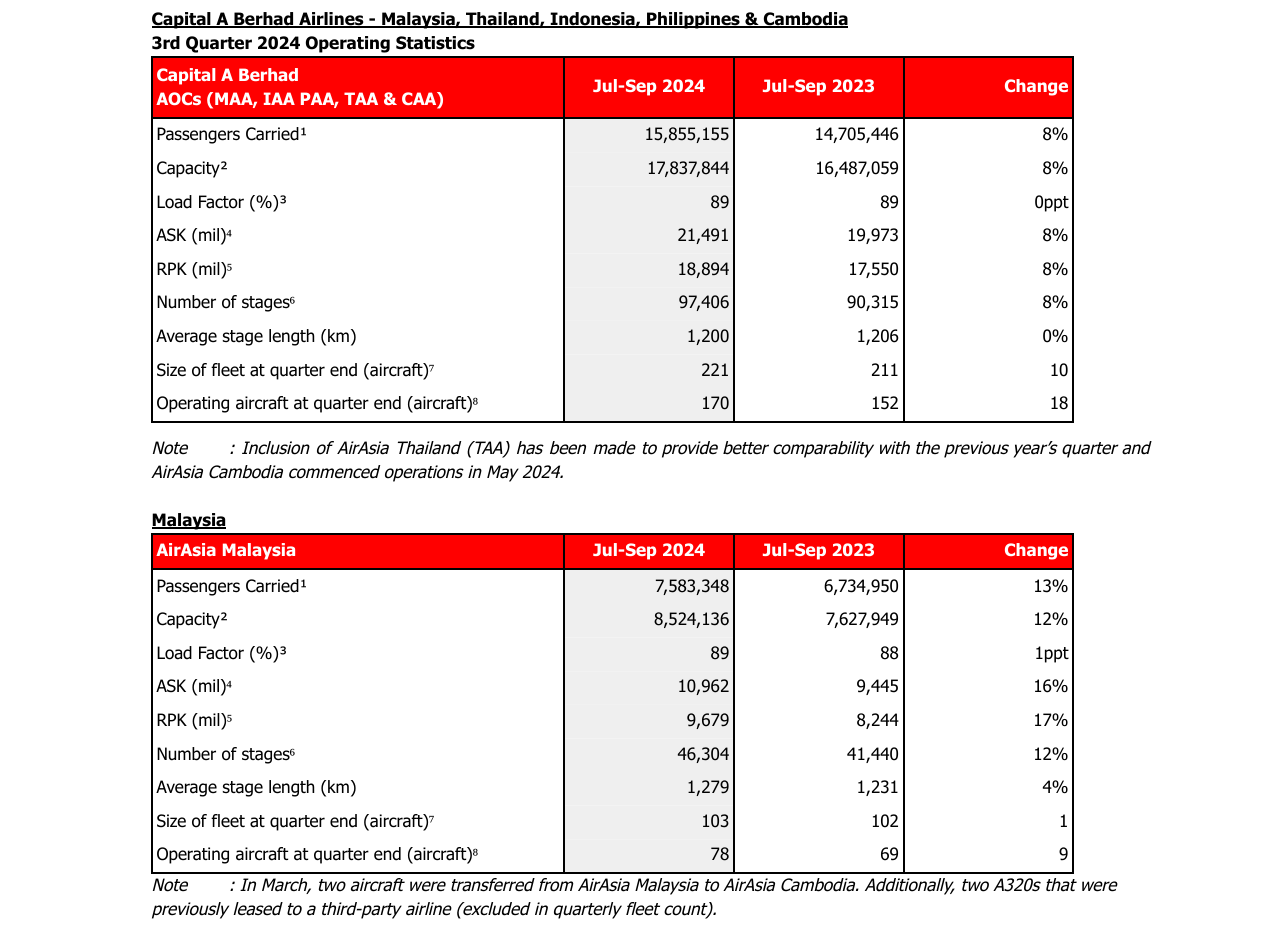

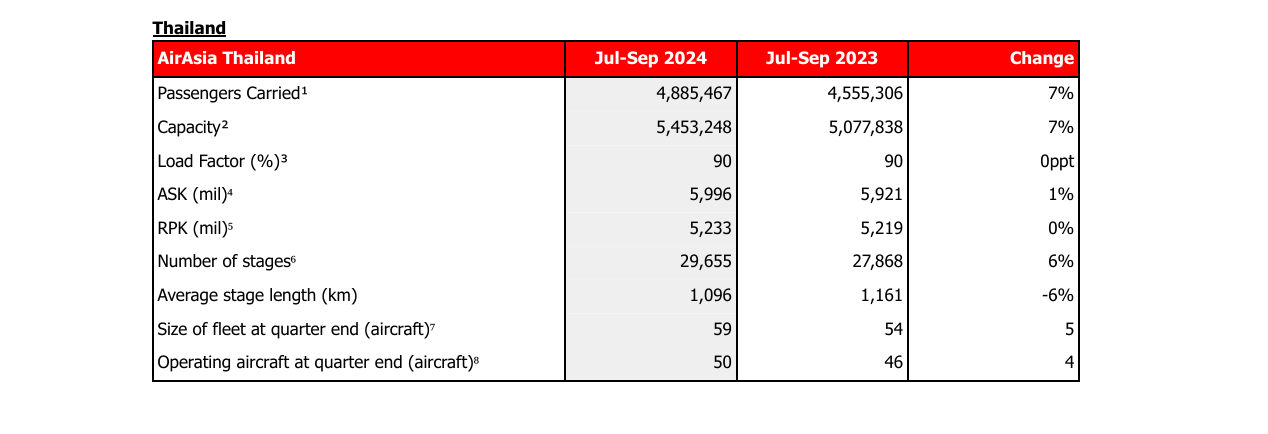

The aviation group – AirAsia Malaysia, AirAsia Thailand, AirAsia Indonesia, AirAsia Philippines, and AirAsia Cambodia (collectively “AirAsia” or the “Group”) delivered robust operational performance, maintaining a remarkably high load factor of 89% in the third quarter of 2024, despite a seasonally slower quarter. During this period, the Group added three new A321neo aircraft and reactivated three additional aircraft, bringing its total activated fleet to 202 out of 216, positioning AirAsia to capitalise on the growing travel demand across the region.

Third quarter passenger traffic increased by 8% Year-on-Year (“YoY”) to nearly 16 million on the back of similar growth in seat capacity. Notably, the Group’s newest airline, AirAsia Cambodia demonstrated remarkable performance with passenger volume surging 62% Quarter-on-Quarter (“QoQ”), contributing to a 15 percentage point (“ppt”) improvement in load factor.

The international segment experienced robust demand, with passenger growth outpacing capacity growth. Routes to China and India recorded a robust Year-to-Date (“YTD”) load factor of 89%, respectively. In the domestic segment, Malaysia has resumed operations at Subang Airport, launching flights to Sabah and Sarawak. These routes recorded a load factor of 92% since their launch in late August. Excluding AirAsia Cambodia, overall passenger numbers are nearing pre-pandemic levels, with YTD recovery reaching 85% of pre-Covid figures, surpassing capacity recovery of 81%.

3Q2024 OPERATING HIGHLIGHTS OF CAPITAL A COMPANIES

CAPITAL A AVIATION SERVICES (“CAPAS”)

Asia Digital Engineering (“ADE”)

Despite closing down permanently one existing hangar in KLIA, ADE's hangar capacity still expanded from seven lines to 12 during the quarter, following the launch of the first six lines of its newly constructed 14-line MRO hangar in August. In 3Q2024, ADE completed 13 base maintenance checks, a slight decline compared to the prior year. This is because as AirAsia aircraft reactivation nears completion, the aircraft that went in for maintenance require more extensive base checks, which include comprehensive structural inspections that need extended grounding and work times.

Meanwhile, the line maintenance checks completed in this quarter surpassed 3,000, a 17% YoY increase driven by the operational launch of ADE in the Philippines and Indonesia. Apart from AirAsia as the anchor customer, ADE has recorded a 20% QoQ increase in number of line checks performed on third-party airlines during the quarter, contributing to the overall growth in line maintenance checks.

Santan

Santan has streamlined its operations, focusing only on food and beverage. Meanwhile, the duty-free and merchandise business have been transferred to AirAsia Move for improved efficiency.

Inflight Catering: The segment experienced a slight 5% YoY decline. This was mainly due to lower sales of non-perishable items by 22% YoY, but was compensated by a 2% and 19% increase in sales of pre-book and onboard perishable items. The shift is due to the change in purchasing behaviour favouring combo-meals, which is classified as perishable units. Hence, despite the drop in units sold, the average spend is expected to be higher, driven by the combo-meals purchase.

Ready-to-eat Meal: The segment experienced a remarkable surge, with unit sales increasing from just over 700 in 3Q2023 to nearly 230,000 in 3Q2024. This was driven by Santan's successful expansion of partnerships with retailers like Secret Recipe and Tealive, alongside onboarding of a third party customer, Ang Ang Roastery during the quarter, and higher recurring orders from existing partners.

Restaurant and Cafe: Unit sales continue to rise, increasing 116% YoY or 8% QoQ to reach over 630,000 units in 3Q2024. This surge is due to active menu management offering a variety of options which resulted in higher quantities repurchased by the respective outlets.

TELEPORT

Teleport maintained its strong growth trajectory in 3Q2024, moving 77,341 tonnes, a 31% year-on-year increase and a 21% rise from the previous quarter. Of this, 15.7 million e-commerce parcels were delivered, marking a 113% year-on-year increase. This reflects Teleport's shift from a traditional cargo business to providing more value-added end-to-end ecommerce services, with average daily volumes reaching 171,000 parcels. This success was driven by Teleport’s strong client integration, allowing operations to adapt quickly to the dynamic needs of its e-commerce clients while maintaining high service quality.

Growth was supported by an 11% expansion in available capacity, bolstered by new Air Partners contributing 7X increase in capacity YoY. Enhanced freighter reliability and increased availability of belly capacity on passenger flights further improved overall capacity. Despite these capacity increases, utilisation rates rose by 3 ppt, reflecting strong sales and improved operational efficiency.

MOVE DIGITAL

AirAsia MOVE

AirAsia MOVE continues to transition the platform as a travel app and aims to be Asean’s favourite travel companion, creating inclusive and delightful journeys for all travellers. Efforts have been taken to drive traffic and improve experience on the app, which saw a 1% quarterly improvement in MAU.

Travel: Due to improved user experience and content, non-AirAsia airline bookings have shown an impressive annual growth of 50%, a conscious effort in diversifying the travel segment income. The core travel contributor, AirAsia flights still remain a challenge with the overall bookings down by 20% YoY due to temporary pricing pressures as well as impact of the Crowdstrike incident. Meanwhile, the Hotels segment grew 35% YoY on the back of improved assortment and personalisation offers and the strong momentum is expected to continue in the following quarters.

Ride Hailing: With a focus on profitability, there has been an upward pricing adjustment and controlled marketing and incentives, which resulted in airport ride bookings experiencing a moderate decrease of 20% YoY. However, there has been a positive 3% improvement in completion rate, reflecting enhanced operational performance. The focus moving forward is on boosting demand and improving the airport transfer experience, with a target of reaching an 80% completion rate by 4Q2024, paving the way for stronger outcomes and greater customer satisfaction

Rewards: Active members have been growing 22% YoY to 6 million. Concurrently, rewards gross billing grew by 6% YoY driven by higher points issuance and improved redemption rates. This growth was fueled by successful onboarding of more external partners, offering more avenues for our members to earn loyalty points. Moving forward, the focus is on getting more external partners to join the rewards program and enabling points redemption outside the AirAsia ecosystem, allowing members to use points like cash.

BigPay

BigPay's user acquisition remained steady, with quarterly carded users increasing by 8% YoY to reach 1.6 million. Notably, 44% of new users this quarter were acquired through AirAsia Move, an increase of 8% QoQ driven by the launch of BigPay Lite in mid-August highlighting the successful collaboration between the entities. As BigPay intensified its efforts to achieve EBITDA profitability, it focused on building and promoting existing features with positive unit economics.

Payment: This segment saw a 32% YoY decrease in the overall GTV, largely from decline in unprofitable card transactions. Despite the decline, DuitNow QR transactions, which are profitable, saw an increase of 69% YoY.

Remittance: Remittance GTV grew by 1% YoY as strong adoption continues for domestic DuitNow transfers.

Lending: Value of loan disbursements grew 59% YoY as BigPay continues to leverage alternative data to identify low risk customers.

3Q2024 OPERATING HIGHLIGHTS OF ASSOCIATE COMPANIES

Ground Team Red (“GTR”)

GTR continued its strong growth trajectory in the third quarter, securing contracts with three additional foreign airlines in KLIA. Simultaneously, the company has made significant strides in sustainability, introducing 20 units of electric baggage tractors to its fleet, demonstrating its commitment to environmentally friendly operations. This not only reduces GTR's carbon footprint but also positions the company as a forward-thinking leader in the ground handling sector, likely to attract environmentally conscious airlines and open doors to new partnership opportunities.

Flight handling: Handled over 41,000 flights, representing an 8% YoY increase. This growth is in tandem with the upward trend across both short-haul and long-haul AirAsia operations.

Passenger handling: Recorded a 14% YoY improvement in passenger handling, with GTR handling a total of 6.7 million passengers during the quarter. This was driven by an increase in AirAsia passenger traffic, particularly from the long-haul sectors. In addition, GTR expanded its operations by adding a new station, SZB, to its territory on 30 August 2024.

Cargo handling: Managed over 34,000 tonnes of cargo in 3Q2024, representing a surge of 42% YoY. The increase was primarily driven by an increase in the e-commerce demand and the addition of two Teleport freighters to the fleet in November 2023.