AirAsia Group Berhad Fourth Quarter and Full Financial Year 2019 Preliminary Operating Statistics

AirAsia Group Berhad is pleased to announce the operating statistics for the fourth quarter of the financial year 2019 (“4Q2019”) and the full financial year ended 31 December 2019.

AirAsia Group Berhad Consolidated AOCs continues to report growth in 4Q2019, with the total number of passengers carried up 9% year-on-year (“YoY”). Capacity expanded by 11% YoY, driven by large increases in Indonesia and Philippines, however load factor dipped slightly by 2 percentage points (“ppts”) to 82% in 4Q2019 due to the higher capacity.

In 4Q2019, AirAsia Malaysia added 4% more capacity and carried 2% more passengers YoY, with a softer load factor of 82% due to change in pricing strategy. AirAsia Malaysia launched two new international routes, including a new unique route to Da-Lat in Vietnam from Kuala Lumpur. AirAsia Malaysia also began running commercial flights with its newly delivered Airbus A321neo in November 2019. For the full year 2019, AirAsia Malaysia carried 8% more passengers, faster than industry growth, reflecting continuing market share gain.

AirAsia Indonesia’s capacity increase was significant at 32% higher than in 4Q2018. The number of passengers carried grew 30% compared to the previous corresponding quarter, recording marginally lower load factor of 81% owing to the higher capacity. During the period, AirAsia Indonesia launched six new routes, which are Jakarta-Belitung, Jakarta-Sorong, Kuala Lumpur-Belitung, Kuala Lumpur-Pontianak, Jakarta-Johor Bahru and Surabaya-Lombok.

AirAsia Philippines also posted a robust capacity growth during the quarter, up 27% YoY following the introduction of a new route, Manila-Bacolod in addition to frequency increases across popular domestic and international routes such as Cagayan de Oro-Manila, Manila-Caticlan and Bangkok-Manila. Load factor was however lower by 4 ppts to 85% due to the large increase in capacity. The number of passengers carried grew by 21% YoY.

AirAsia Thailand reduced capacity by 2% YoY as it continues to focus on capacity realignment and route rationalisation to enhance efficiency and better match demand. Correspondingly, the number of passengers carried dipped by 1%, holding load factor firm at 86%.

AirAsia India reported a remarkable growth in 4Q2019. Total passengers carried boosted by 39% YoY on the back of a 38% ramp up in capacity, improving load factor by 1 percentage point to achieve 87%. AirAsia India strengthened its domestic position by introducing several new routes in 4Q2019, ending the year with a fleet size of 28, taking in an additional 6 aircraft in the quarter.

AirAsia Japan’s capacity expanded by 94% while ASK increased by 74% following the launch of its third route, Nagoya-Sendai in 3Q2019. Load factor held steady at 72%, supported by a 95% YoY growth in passengers carried.

For the full year of 2019, for all six AOCs, it was another year of notable growth, carrying 12% more passengers YoY, reaching a total of 83.5 million passengers. Capacity expansion was significant during the year at 11% YoY on the back of taking 19 more aircraft, ending the year with a fleet size of 243 aircraft. AirAsia Group successfully achieved its target load factor of 85% for 6 AOCs in 2019.

AirAsia Group Berhad Consolidated AOCs – Malaysia, Indonesia & Philippines

4th Quarter 2019 Operating Statistics

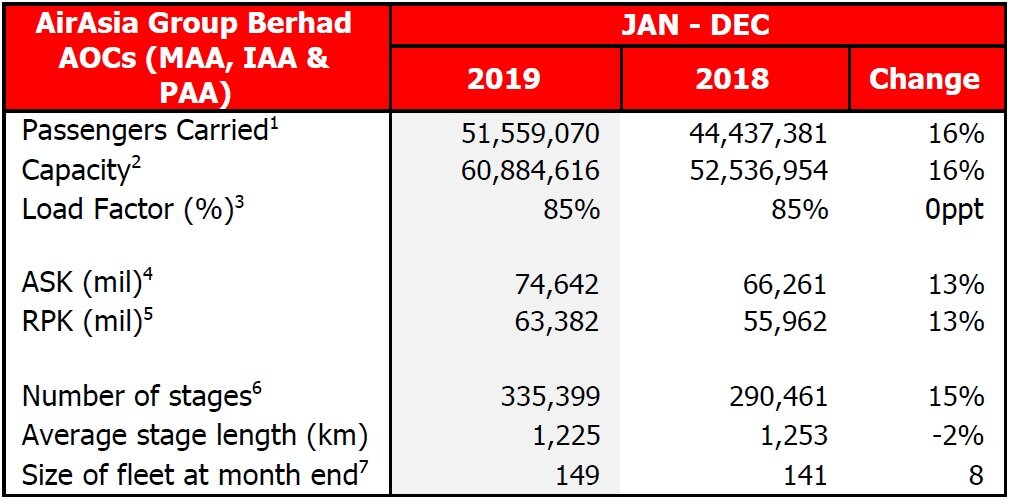

Full Year 2019 Operating Statistics

Note: (i) The fleet count excludes:

- Two (2) A320 aircraft leased to a third party airline

Malaysia

4th Quarter 2019 Operating Statistics

Full Year 2019 Operating Statistics - Malaysia

Note: (ii) The fleet count excludes:

- Two (2) A320 aircraft leased to a third party airline

Indonesia

4th Quarter 2019 Operating Statistics

Full Year 2019 Operating Statistics - Indonesia

Note: (iii) The fleet count includes:

- Eight (8) A320 aircraft operated by PT. Indonesia AirAsia Extra (IAAX) transferred to AirAsia

Indonesia in 4Q 2018.

Philippines

4th Quarter 2019 Operating Statistics

Full Year 2019 Operating Statistics - Philippines

Thailand

4th Quarter 2019 Operating Statistics

Full Year 2019 Operating Statistics - Thailand

India

4th Quarter 2019 Operating Statistics

Full Year 2019 Operating Statistics - India

Japan

4th Quarter 2019 Operating Statistics

Full Year 2019 Operating Statistics - Japan

(1) Number of earned seats flown. Earned seats comprise seats sold to passengers (including no-shows)

(2) Number of seats flown

(3) Number of Passengers carried as a percentage of Capacity

(4) Available Seat Kilometres (ASK) measures an airline’s passenger capacity. Total seats flown multiplied by the number of kilometres flown

(5) Revenue Passenger Kilometres (RPK) is a measure of the volume of passengers carried by the airline. Number of passengers multiplied by the number of kilometres these passengers have flown

(6) Number of flights flown

(7) Number of aircraft including spares

¹ AirAsia Group Berhad Consolidated AOCs refers to AOCs whose financial and operational results are consolidated for financial reporting purposes and these are namely the Malaysian, Indonesian and Philippine AOCs.